Daftar isi: [Hide]

- 1🏠 What Is a Home Equity Loan?

- 2💰 Why You Should Check Home Equity Loan Rates Today

- 3📊 How to Use a Home Equity Loan Rates Today Calculator

- 4📉 Average Home Equity Loan Rates Today (October 2025)

- 5🧮 Example Calculation: How Much Can You Borrow?

- 6✅ Pros and Cons of a Home Equity Loan

- 6.1Advantages

- 6.2Disadvantages

- 7📋 How to Qualify for the Best Home Equity Loan Rates

- 8📱 Top Online Home Equity Loan Calculators

- 9❓ FAQ: Home Equity Loan Rates Today Calculator

- 9.31. What is the difference between a home equity loan and a HELOC?

- 9.42. How often do home equity loan rates change?

- 9.53. Can I use the calculator for a second home or investment property?

- 9.64. Is my credit score affected by using a calculator?

- 9.75. Are home equity loan interest payments tax-deductible?

- 10🚀 Final Thoughts: Plan Smart with a Home Equity Loan Calculator

- 11💡 Call to Action

- 12📌 The password is in the YouTube video : @DJDikiRMX (TEAM PART 5) JOIN TEAM HERE ✅

🏠 What Is a Home Equity Loan?

A home equity loan allows homeowners to borrow money against the value of their home. Essentially, you are tapping into the equity — the difference between your home’s market value and the balance owed on your mortgage. This type of loan is ideal for large expenses such as home renovations, debt consolidation, or education costs. Home equity loans typically come with fixed interest rates and predictable monthly payments, making them easier to budget compared to variable-rate lines of credit. Understanding home equity loan rates today helps you choose the best option for your financial goals.💰 Why You Should Check Home Equity Loan Rates Today

Interest rates fluctuate frequently based on market trends, inflation, and Federal Reserve decisions. By comparing home equity loan rates today, you can lock in a lower rate and save thousands over the life of your loan.- Lower interest rates mean reduced monthly payments.

- Fixed-rate options provide stability over time.

- Competitive lender offers can help you save more.

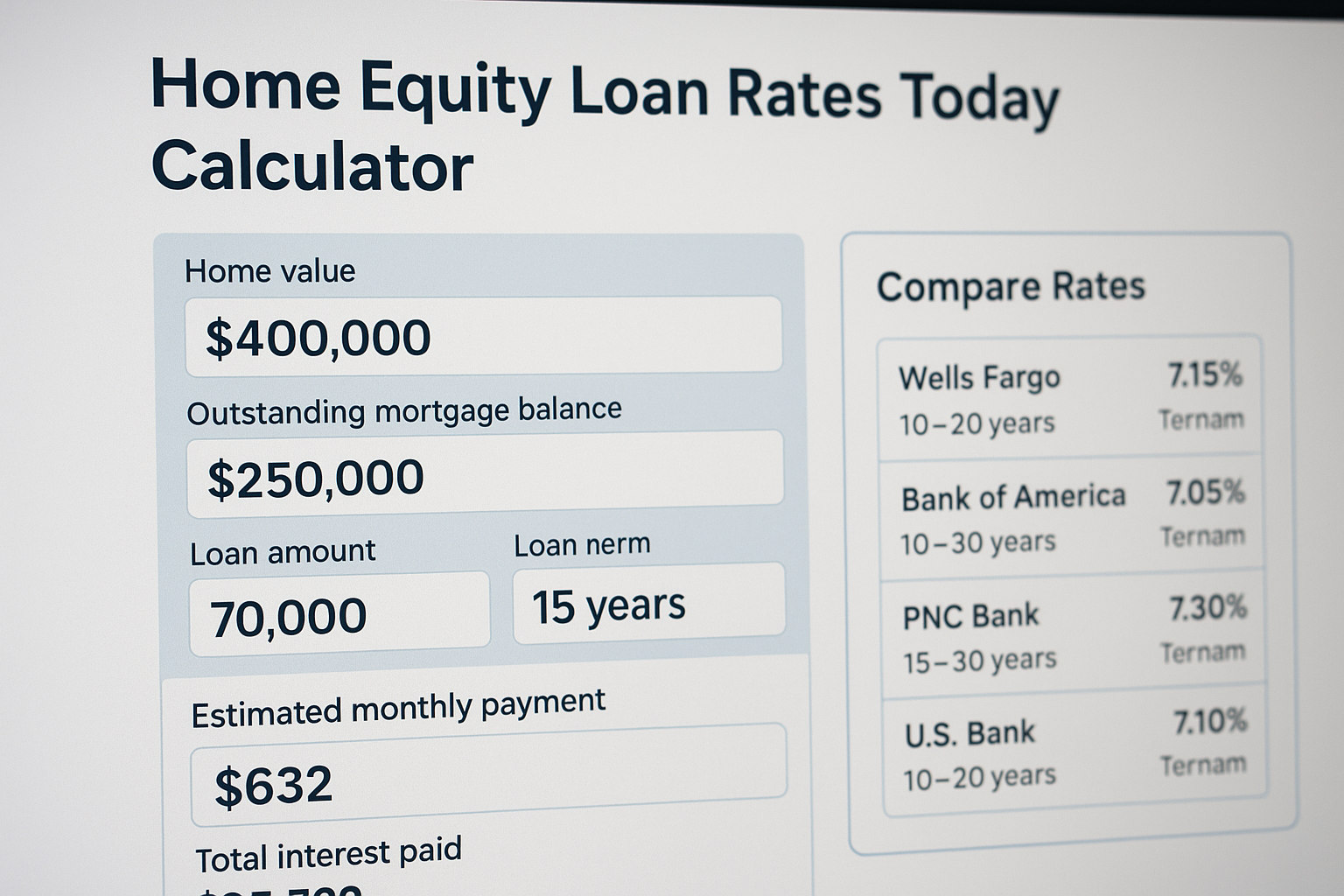

📊 How to Use a Home Equity Loan Rates Today Calculator

The home equity loan rates today calculator helps you estimate your monthly payments based on the loan amount, interest rate, and term length. Here’s how to use it effectively:- Enter your home’s estimated value: Use current market prices or appraisal values.

- Subtract your remaining mortgage balance: This gives your available equity.

- Decide your loan amount: Most lenders allow borrowing up to 80–85% of your home’s equity.

- Input today’s average rate: Use the current rate displayed by your chosen lender or comparison site.

- Choose the term length: Usually between 5 to 30 years.

📉 Average Home Equity Loan Rates Today (October 2025)

As of October 2025, average home equity loan rates are as follows (for borrowers with good to excellent credit):| Lender | Interest Rate (APR) | Loan Term | Max Loan-to-Value (LTV) |

|---|---|---|---|

| Wells Fargo | 7.15% | 10–20 years | 85% |

| Bank of America | 7.05% | 10–30 years | 80% |

| PNC Bank | 7.30% | 15–30 years | 85% |

| U.S. Bank | 7.10% | 10–20 years | 85% |

| Discover Home Loans | 7.20% | 10–30 years | 90% |

🧮 Example Calculation: How Much Can You Borrow?

Let’s say your home is worth $400,000 and your remaining mortgage balance is $250,000. You have $150,000 in equity. If your lender allows borrowing up to 80% of your home’s value, you could access: ($400,000 × 80%) – $250,000 = $70,000 Using a rate of 7.1% for 15 years, your estimated monthly payment would be about $632. The calculator quickly gives you these numbers so you can plan effectively before applying.✅ Pros and Cons of a Home Equity Loan

Advantages

- Fixed, predictable payments

- Potentially lower interest rates than credit cards

- Interest may be tax-deductible (consult a tax advisor)

- Funds can be used for any purpose

Disadvantages

- Your home serves as collateral

- Closing costs and fees may apply

- Long-term commitment with fixed rates

- Risk of foreclosure if you fail to repay

📋 How to Qualify for the Best Home Equity Loan Rates

To secure the most competitive home equity loan rates today, focus on these key factors:- Credit score: Aim for 700 or higher.

- Debt-to-income ratio (DTI): Keep it under 43%.

- Loan-to-value (LTV): Borrow less than 85% of your home’s value.

- Steady income: Demonstrate consistent earnings or job stability.

- Property value: A recent appraisal can strengthen your application.

📱 Top Online Home Equity Loan Calculators

Here are some trusted platforms where you can check home equity loan rates today and use their calculators for free:❓ FAQ: Home Equity Loan Rates Today Calculator

1. What is the difference between a home equity loan and a HELOC?

A home equity loan offers a lump-sum amount with fixed payments, while a HELOC (Home Equity Line of Credit) allows flexible borrowing with variable interest rates.2. How often do home equity loan rates change?

Rates can fluctuate weekly based on market conditions and central bank policies. Checking today’s rates helps you capture the lowest available offer.3. Can I use the calculator for a second home or investment property?

Yes, but note that rates for non-primary residences are usually higher due to added risk.4. Is my credit score affected by using a calculator?

No, using an online calculator is completely safe and does not impact your credit score.5. Are home equity loan interest payments tax-deductible?

Interest may be deductible if the funds are used for home improvements. Always verify with a tax advisor.🚀 Final Thoughts: Plan Smart with a Home Equity Loan Calculator

Before applying for a loan, always compare home equity loan rates today and use a calculator to visualize your repayment plan. This ensures transparency and helps you avoid financial surprises later on. Whether you’re renovating your home or consolidating debt, a home equity loan rates today calculator gives you the confidence to make data-driven financial decisions.💡 Call to Action

Ready to explore your options? Use our Home Equity Loan Rates Today Calculator now to estimate your savings and find the best lender near you. Compare rates, calculate payments, and take the next step toward financial freedom today!

📌 The password is in the YouTube video : @DJDikiRMX (TEAM PART 5) JOIN TEAM HERE ✅

Wait 60 seconds

Incorrect password. Try again.

💬 Have any tips of your own? Share them in the comments below!