Daftar isi: [Hide]

- 1What Is a Refinance Mortgage Rates Calculator 30 Year?

- 2Why Consider Refinancing in 2025?

- 3Step-by-Step Guide: How to Use a Refinance Mortgage Rates Calculator 30 Year

- 4Benefits of a 30-Year Fixed Refinance

- 5Tips to Get the Best Refinance Mortgage Rates in 2025

- 6Common Mistakes Homeowners Make When Refinancing

- 7Real-Life Example: How a Calculator Saves Money

- 8Is Refinancing Right For You?

- 9Frequently Asked Questions (FAQ)

- 10📌 The password is in the YouTube video : @DJDikiRMX (TEAM PART 5) JOIN TEAM HERE ✅

What Is a Refinance Mortgage Rates Calculator 30 Year?

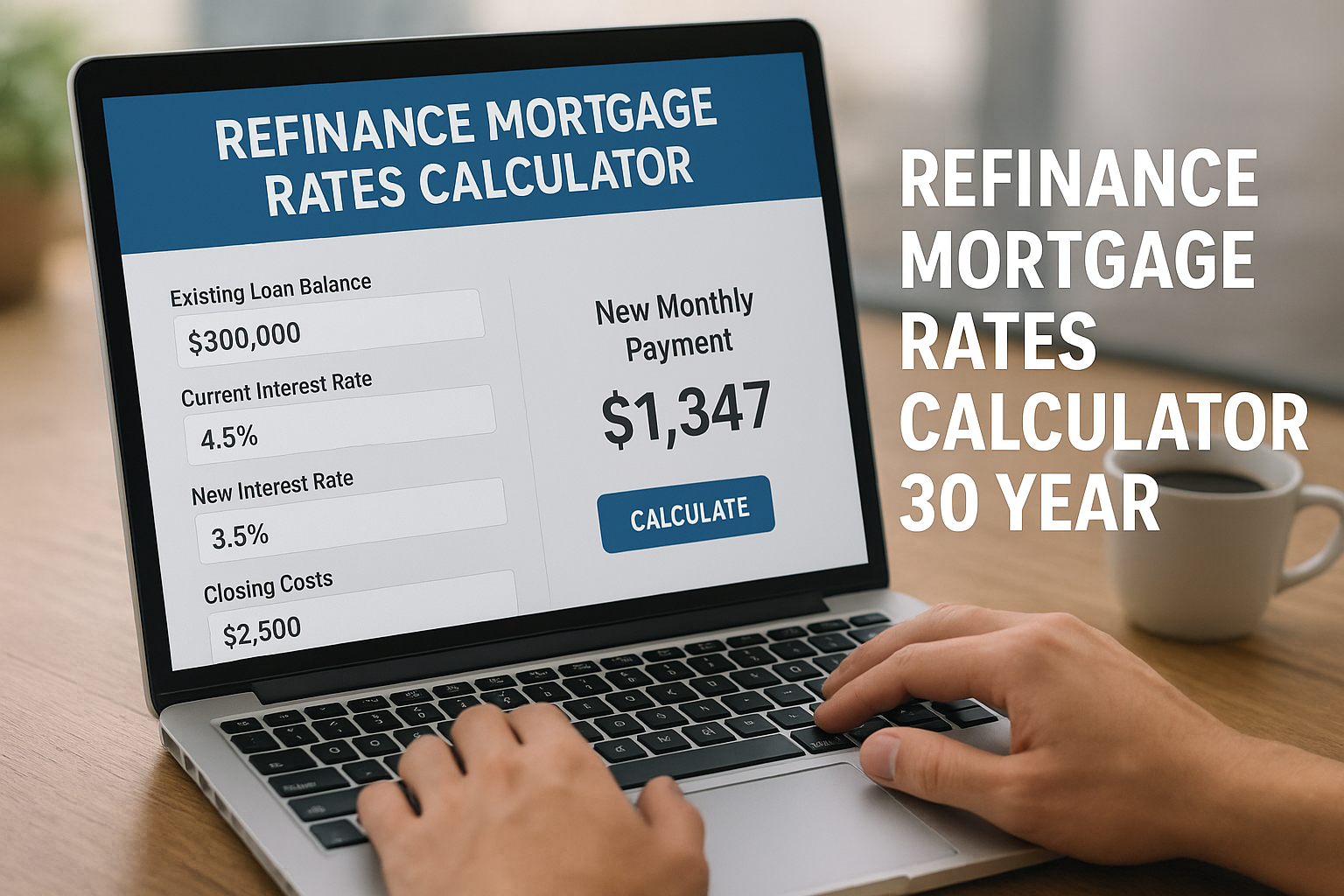

A refinance mortgage rates calculator 30 year is an online tool that helps homeowners estimate new monthly payments if they refinance their existing mortgage. By inputting details such as loan balance, current interest rate, new rate offers, and closing costs, you can compare different refinancing scenarios instantly.

- Estimating monthly payments based on a 30-year fixed rate.

- Showing total interest paid over the life of the loan.

- Factoring in closing costs and fees.

- Helping you decide if refinancing is financially worth it.

Why Consider Refinancing in 2025?

Mortgage markets shift constantly. In 2025, factors such as inflation, Federal Reserve policy, and housing demand are shaping interest rates. Using a refinance mortgage rates calculator 30 year ensures you’re not caught off guard.

Benefits of refinancing in 2025 include:

- Lower monthly payments thanks to competitive rates.

- Cash-out refinance options for debt consolidation or home improvements.

- Locking in fixed rates before potential future hikes.

- Improved credit scores leading to better refinancing terms.

Step-by-Step Guide: How to Use a Refinance Mortgage Rates Calculator 30 Year

Here’s a simple process:

- Gather Your Current Mortgage Info

- Loan balance

- Current interest rate

- Remaining term

- Monthly payment

- Enter New Loan Details

- Desired interest rate

- New loan term (30 years fixed)

- Closing costs

- Compare Monthly Payments — see the difference between your current mortgage and the refinanced option.

- Analyze Long-Term Savings — review how much interest you’ll save over 30 years.

- Decide If It’s Worth It — if savings outweigh costs, refinancing may be the right move.

Benefits of a 30-Year Fixed Refinance

Why do most homeowners choose the 30-year fixed refinance?

- Predictable payments: Stable monthly amounts for three decades.

- Lower initial payments: Compared to 15-year loans.

- Flexibility: Extra cash flow for savings, retirement, or investments.

- Better budgeting: Families appreciate financial stability.

Tips to Get the Best Refinance Mortgage Rates in 2025

- Improve Your Credit ScorePay off revolving debt and avoid late payments before applying.

- Shop AroundCompare multiple lenders and use at least 3 different online calculators to verify results.

- Consider PointsPaying upfront points can lower your interest rate — run the math to see if it makes sense.

- Time Your RefinanceWatch Federal Reserve announcements and economic data; lock rates during market dips.

- Negotiate FeesSome lenders may waive or reduce closing costs — always ask.

Common Mistakes Homeowners Make When Refinancing

- Refinancing too often, leading to repeated closing costs.

- Ignoring the break-even point (when savings surpass costs).

- Focusing only on monthly payments, not total interest.

- Forgetting about property taxes and insurance.

Real-Life Example: How a Calculator Saves Money

Case Study:

Current loan: $300,000 at 6.5% (30 years remaining) Monthly payment: $1,896 Total interest: $382,630 Refinance scenario: New rate: 5.0% (30-year fixed) New monthly payment: $1,610 Total interest: $279,767 Savings: $286 monthly and over $102,000 across the loan term.

Is Refinancing Right For You?

Refinancing your home loan can be a game-changer — but only if done right. By using a refinance mortgage rates calculator 30 year, you can instantly see whether switching to a new loan will save you money or cost you more.

Compare Rates from Top Lenders Now

Frequently Asked Questions (FAQ)

How accurate are refinance mortgage calculators?

They provide close estimates, but final numbers depend on lender fees, credit approval, and the appraisal. Use calculators as a planning tool, not a final quote.

Is it worth refinancing if rates drop by 1%?

Yes — even a 1% drop can save thousands, especially on large loans. Check the break-even point to make sure savings exceed costs.

Can I refinance with bad credit?

It’s possible, but rates will be higher. Improving your credit score before applying typically results in better terms.

How long does refinancing take in 2025?

On average, 30–45 days depending on documentation, appraisal scheduling, and lender processing speed.

What is the break-even point in refinancing?

The break-even point is when the savings from lower monthly payments surpass the costs of refinancing (closing costs, fees, points).

📌 The password is in the YouTube video : @DJDikiRMX (TEAM PART 5) JOIN TEAM HERE ✅

💬 Have any tips of your own? Share them in the comments below!